Fintech Company Audit: Security Standards Compliance

100%

regulatory gap removal

compliance certificate acquisition

0$

regulatory fines

Client

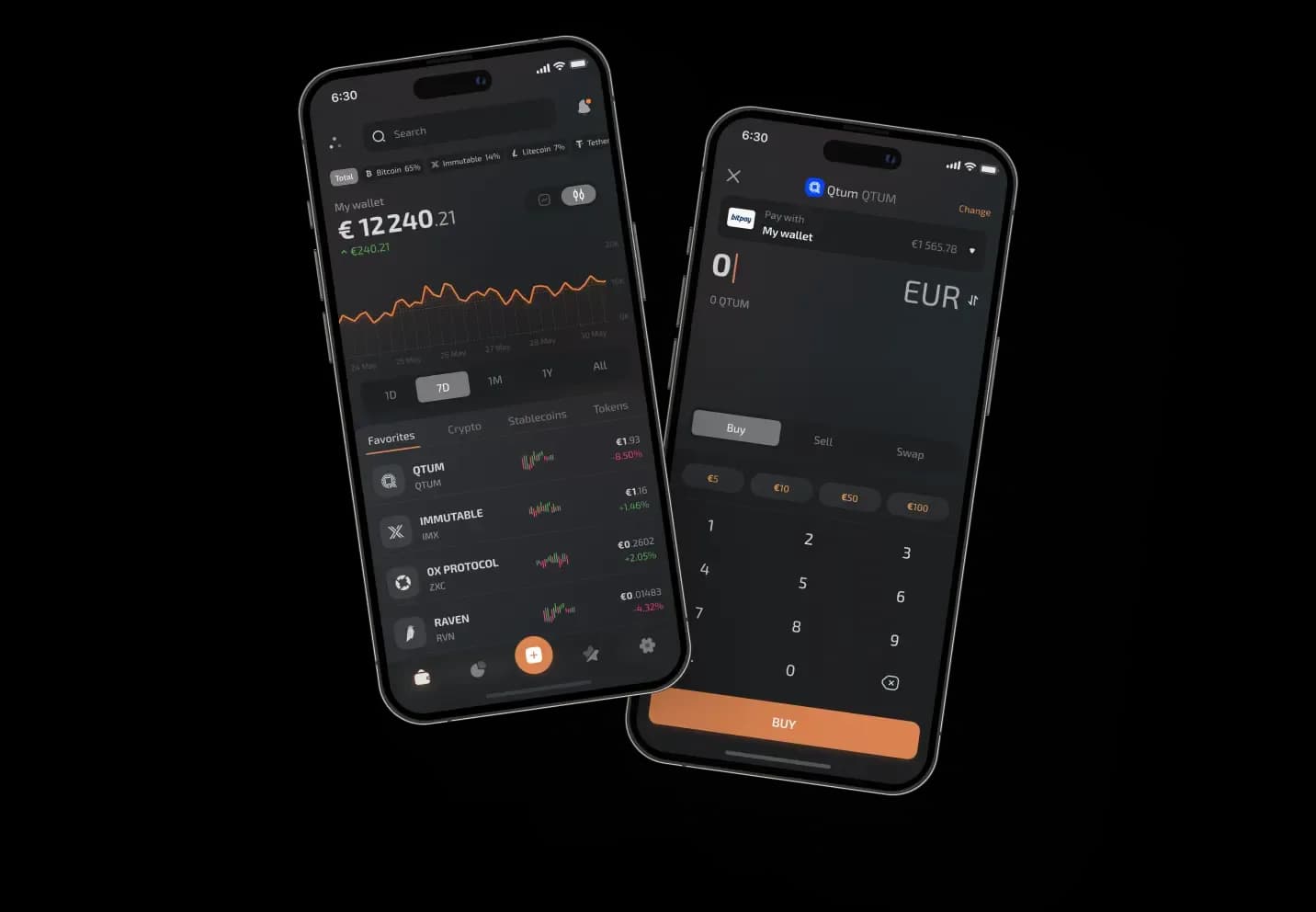

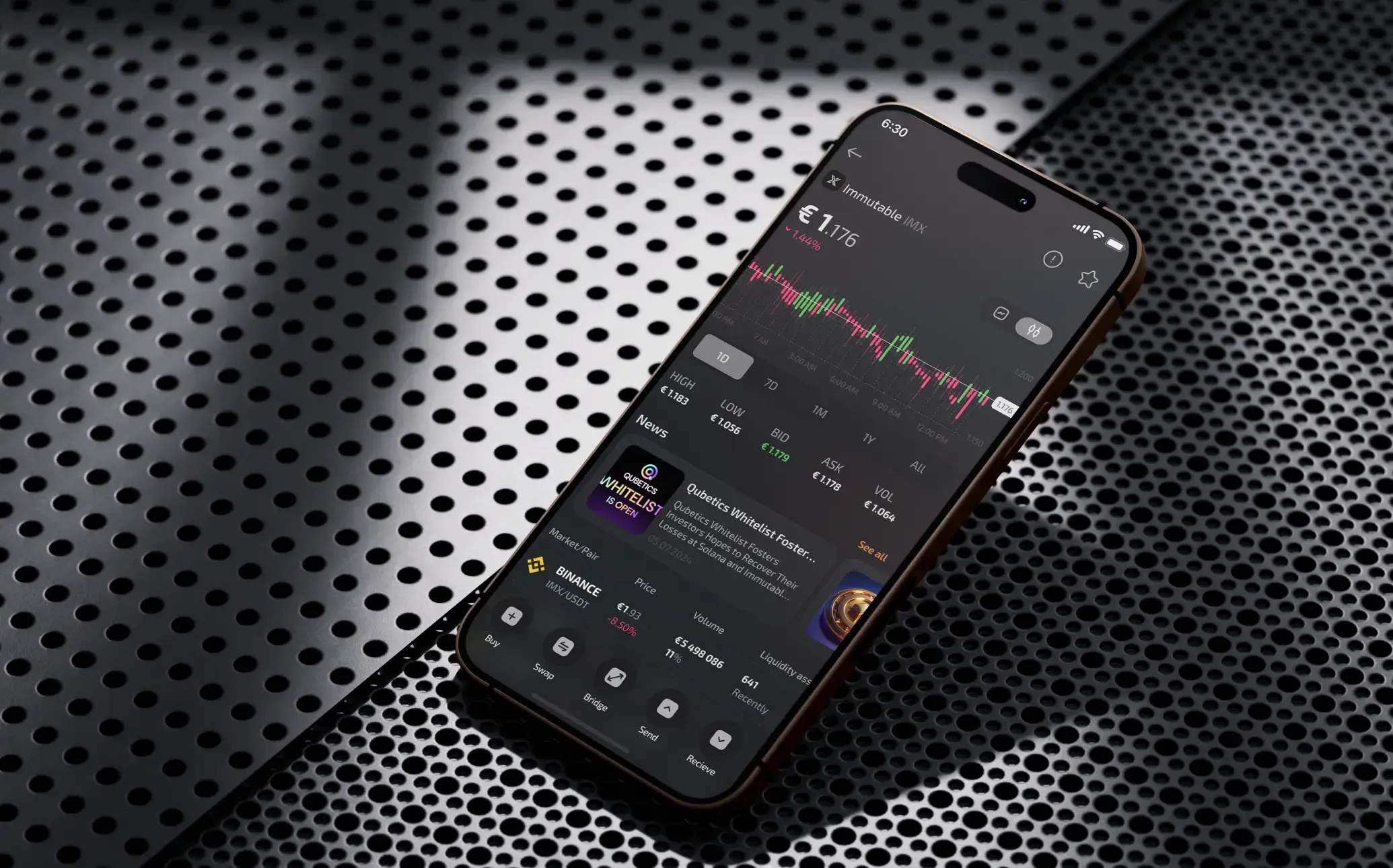

A dynamic fintech company located in Eastern Europe partnered with Modsen to conduct a comprehensive IT security audit aimed at fortifying its compliance with stringent international fintech standards. The company developed a web and mobile cryptocurrency application that enabled buying, selling, and managing cryptocurrencies, as well as monitoring market trends and industry-related news.

Business vertical

Fintech

Team size

5 Experts

Project duration

2,5 weeks

Challenge

The finance company that turned to us for IT security auditing, was preoccupied with the prompt and infallible identification of security gaps and sought expert recommendations on their efficient patching. The scope of challenges brought before Modsen team comprised:

Assessment of the product's compliance with key fintech industry security standards for blockchain-based apps;

Implementation of penetration testing before the audit;

Penetration test analysis;

Audit result analysis and recommendations documenting.

Estimate the cost of IT consulting services for your project

Leave your email and our experts will provide an accurate estimation of the cost and duration of our IT advisory cooperation.

Project scope

The task Modsen fintech consultants faced envisaged the implementation of the following tasks:

Assess the product's compliance with ISO/IEC 27001, ISO/IEC 27002, OWASP ASVS, BSS, CCSS, PCI DSS, and BSA;

Identify software security gaps and vulnerabilities;

Provide a documented set of recommendations based on identified security breaches and potential gaps.

Consulting process

Consultation inquiry analysis

An initial examination of the client's inquiry formed the basis of our understanding of the challenge and allowed the team to delve into the specificity of the case before we met our fintech partner.

Client requirements gathering

During the two online sessions with the client and their team, Modsen CTO and our senior fintech consultants went over the project requirement details and prepared a comprehensive document outlining our partner's expectations about the cooperation process, audit deadlines, milestones, and monitoring regularity.

Team assembly

A fintech app security audit requires a team of seasoned finance industry experts, well aware of the regulatory compliance intricacies of blockchain-based software. To make sure the project gets the best professionals on the house, Modsen CTO selected 5 leading-edge specialists to handle the task.

Product penetration testing

To deliver security audit results with maximum precision and value, we implemented penetration testing of the system before its assessment to identify the most pressing security issues if any.

Project auditing

The audit process unfolded over 2,5 weeks, marked by a series of clear-cut steps. They involved assessing the fintech application, audit planning, and performing a comprehensive analysis of project data. Throughout the cooperation period, regular communication channels, including daily progress calls and report submissions, were maintained to keep the client abreast of our findings and ensure transparency of the audit process.

Audit results delivery

The finalization of the product security assessment led to the generation of a detailed document outlining our findings. Providing our partner with a comprehensive list of identified security gaps and potential breach-prone spots, we make sure that the results of Modsen-led assessment will be implemented with maximum precision.

Provision of documented recommendations and a remediation plan

The actionable insights gleaned from the audit were compiled into a custom security remediation plan, tailored to the client’s overarching goal of achieving security compliance for the fintech application.

Key deliverables

Identification of fintech security compliance gaps:

Insufficiently strong encryption protocols;

Access controls in need of strengthening;

Breach-prone account creation process;

Lack of a comprehensive disaster recovery plan;

Incomplete compliance with PCI DSS and BSA.

Recommendations for product security strengthening:

Upgrade encryption protocols to meet industry standards.

Conduct a thorough review of existing access control policies.

Introduce multi-factor authentication during the account creation process.

Identify critical systems and data that need to be prioritized for recovery.

Implement necessary changes to meet all PCI DSS requirements, including secure storage and transmission of cardholder data.

Results and impact

Strengthened app security architecture

The engaged team of Modsen fintech consultants performed a comprehensive system audit and penetration testing, that allowed to identify and precisely document all existing security gaps and bridge them following the remediation plan.

Overall security standards compliance

The audit identified several issues in adherence to PCI DSS and BSA, which were pinpointed in the remediation plan and successfully resolved by the client's in-house team.

100%

Prevention of regulatory compliance fines100%

Elimination of fintech security compliance gapsLet's calculate the accurate cost and resources required for your project